what is suta tax rate for 2021

For experience-rated employers those with three or more years of experience the contribution. In November of each year active employers will be mailed an Unemployment Tax Rate Assignment Form.

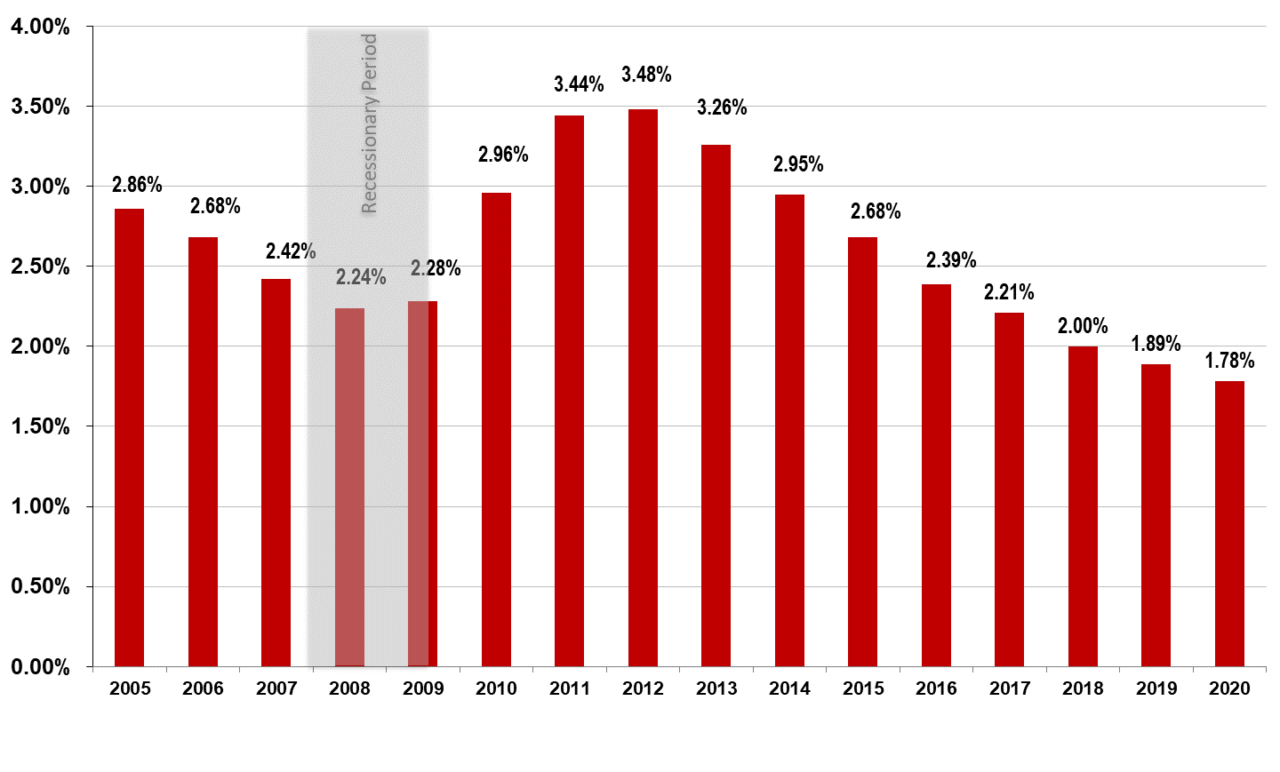

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

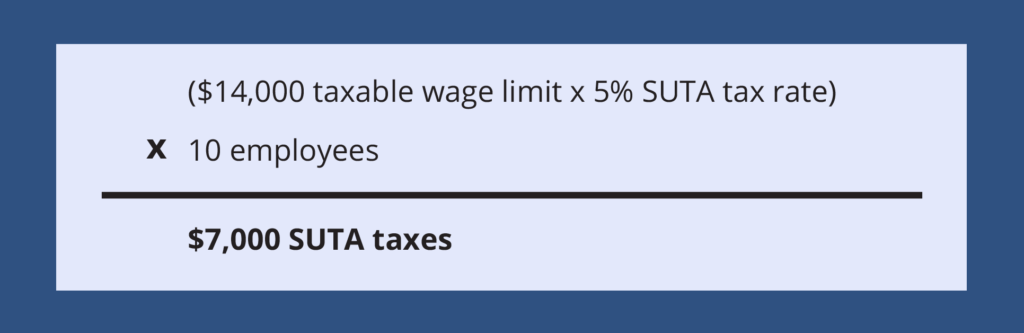

0010 10 or 700 per employee.

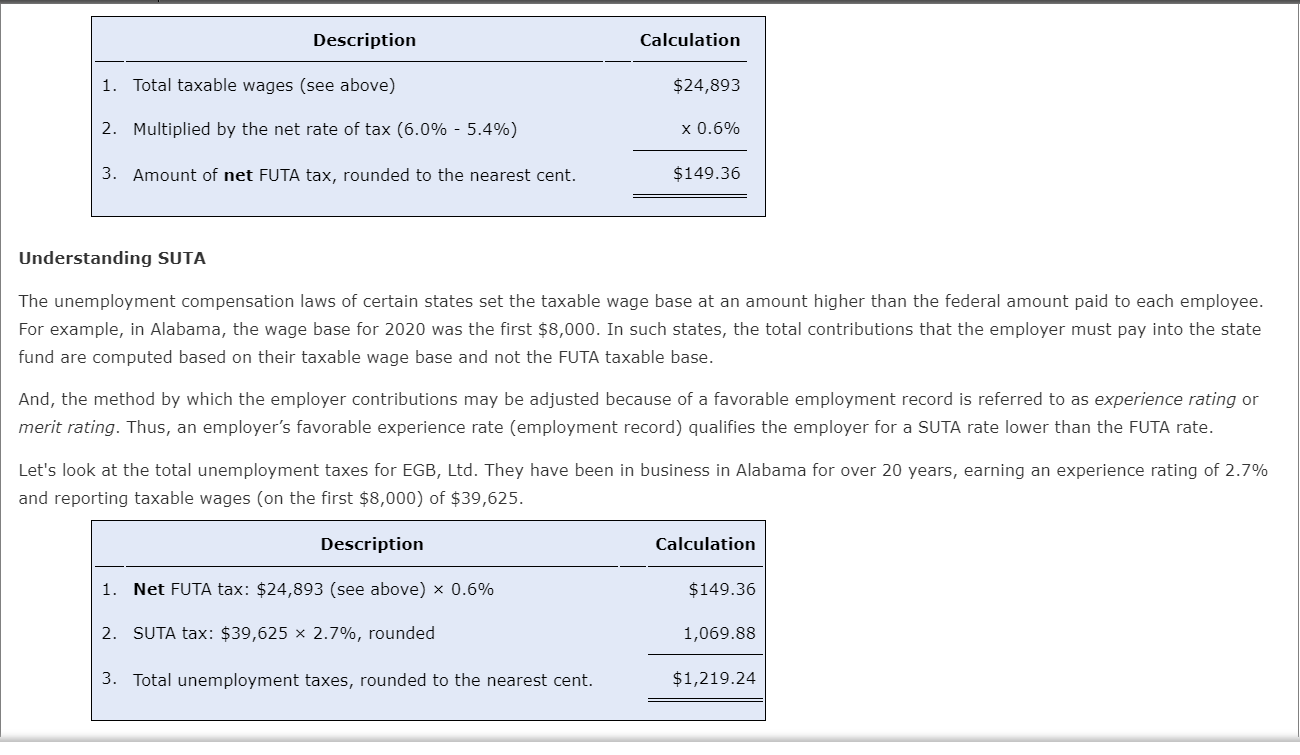

. For example if you own a non-construction. The states SUTA wage base is 7000 per. The chart below outlines 2022 SUTA employer tax rate ranges.

To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. Mailing of 2021 rate notices. December 15 2021.

Mail Date for Unemployment Tax Rate Assignments For 2022. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee. Per Departments website the 2021 employee SDI withholding rate which includes disability insurance and paid family leave increases to 12.

The 2021 employee SUI withholding rate remains at 006 on total wages. Newly liable employers continue with the entry-level tax rate until they are chargeable. The new law reduces the.

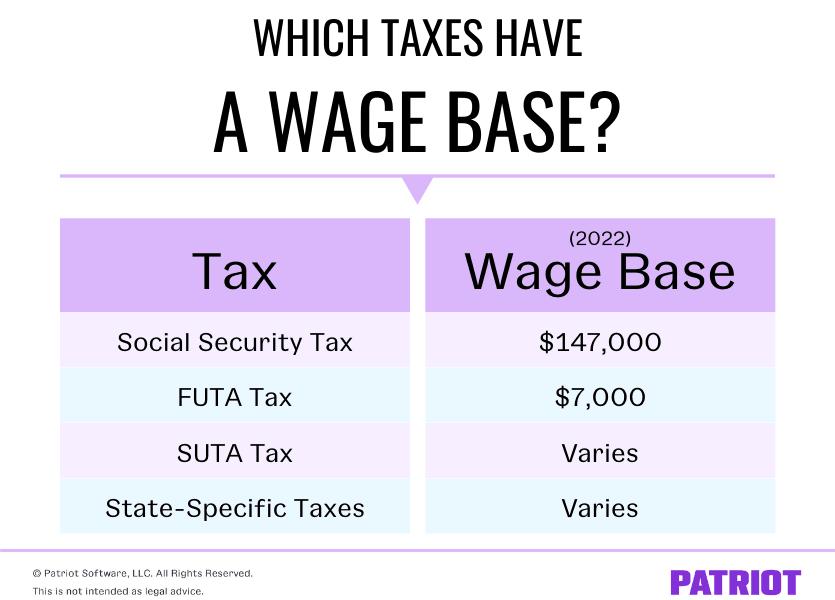

52 rows Each state has a range of SUTA tax rates ranging from 065 to 68. Base Tax Rate for 2022 from 050 to 010. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

Some states have their own SUTA wage base limit. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever is higher. State taxes vary including the State Unemployment Tax Act SUTA contribution rates.

After that you may be eligible for a. The FUTA tax applies to the first 7000 of. If you are a new employer other than a successor to a liable employer you are assigned a tax rate of 20 percent for a minimum of two calendar years.

Employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. Lets say your business is in New York where.

Dumping refers to attempts by employers to pay lower state unemployment taxes than their experience rate allows. You should be aware of current rates and understand how the tax is calculated. The UI rate schedule and amount of taxable wages are.

Click here for an historical rate chart. FUTA Tax Rates and Taxable Wage Base Limit for 2021. Visit your states official government website for complete and.

Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. The wage base limit is the maximum threshold for which the SUTA taxes can be withheld. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. Employers will receive an assessment or tax rate for which they have to pay. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent 37 percent. In 2018 the Tax Cuts and. 2021 SDI rates and taxable wage base.

The federal income tax brackets for the United States in 2021 is as follows. The Department mails SUI. Please note the rates are subject to change.

The SUI taxable wage base continues at 10000 for 2021. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000.

How is the SUTA rate calculated.

Oed Unemployment Ui Payroll Taxes

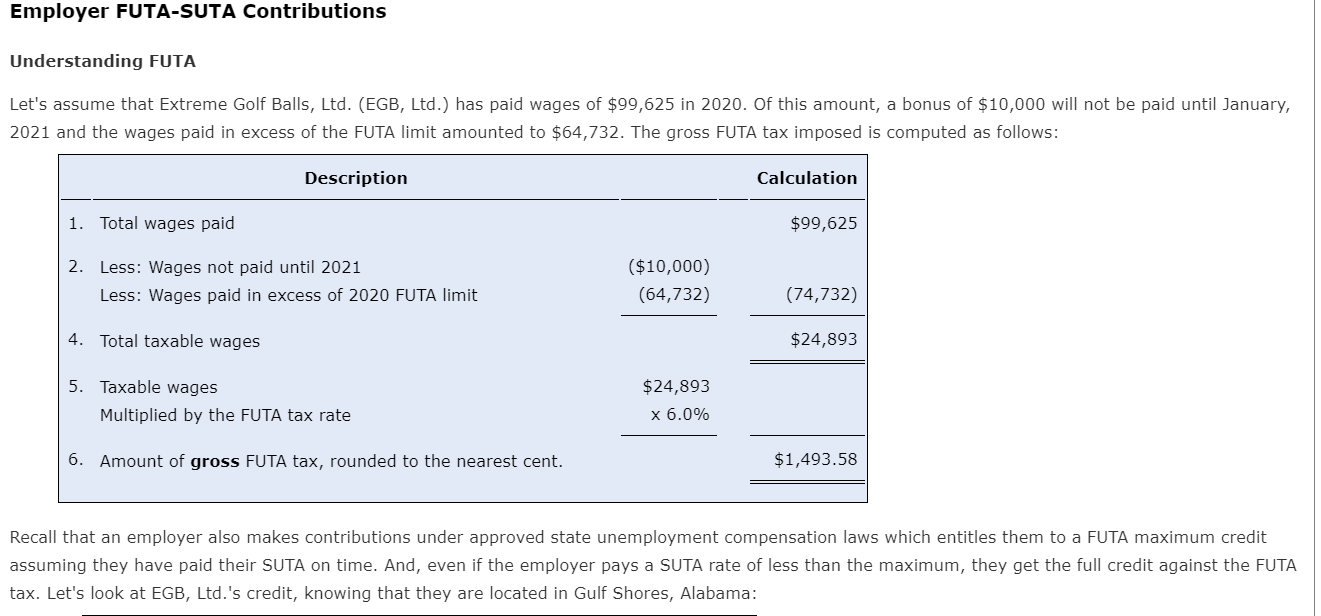

Employer Futa Suta Contributions Understanding Futa Chegg Com

Futa Tax Overview How It Works How To Calculate

What Is A Wage Base Definition Taxes With Wage Bases More

State Unemployment Tax Ballotpedia

Employment Tax Returns Forms Due Dates More

What Is Sui State Unemployment Insurance Tax Ask Gusto

Are Employers Responsible For Paying Unemployment Taxes

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Suta State Unemployment Taxable Wage Bases Aps Payroll

Employer Futa Suta Contributions Understanding Futa Chegg Com

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

940 Futa Suta Tax Rates For 2021 Form 940 Futa Credit Reduction States

What S The Cost Of Unemployment Insurance To The Employer

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

![]()

State Unemployment Tax Ballotpedia

Suta Tax An Employer S Guide To The State Unemployment Tax Act