amazon flex tax documents canada

Or other proprietary information including images text page layout or form of Amazon without express written. Get all your questions answered from how to start earning with Flex how to earn more through our rewards program and more.

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but.

. Driving for Amazon flex can be a good way to earn supplemental income. Youll need to declare your Amazon flex taxes under the rules of HMRC self-assessment. 12 tax write offs for Amazon Flex drivers.

Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. Go to Settings General Profiles or Device.

Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. The forms are also sent to the IRS so take note if youve made more than 600. Royalty or rent income by participating in one or more Amazon programs you may be eligible to receive a.

After your first year you can pay based on your previous years. Payee and earn income reportable on Form 1099-MISC eg. We would like to show you a description here but the site wont allow us.

The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. Gig Economy Masters Course. Youll need to submit a tax return online declaring your.

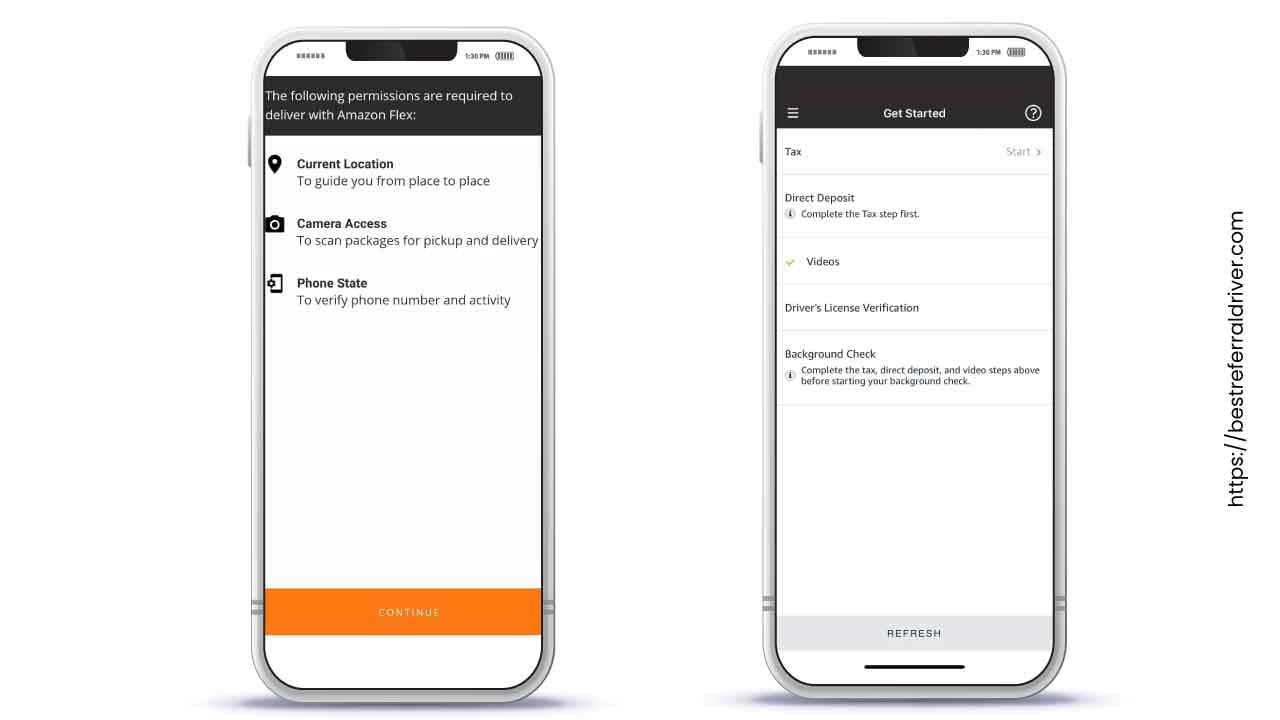

Tax Returns for Amazon Flex. Go to your phones My Files or Downloads folder and tap the Amazon Flex icon to install. Want to deliver for Amazon Flex.

If you use an iPhone set up trust for the app. If this is your first year self-employed most Amazon Flex drivers are safe setting aside 25 to 30 of their pay. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or.

Welcome to the Amazon Flex program the Program. Knowing your tax write offs can be a good way to keep that income in. You expect to owe at least 1000 in tax for the current.

Increase Your Earnings. If you are a US.

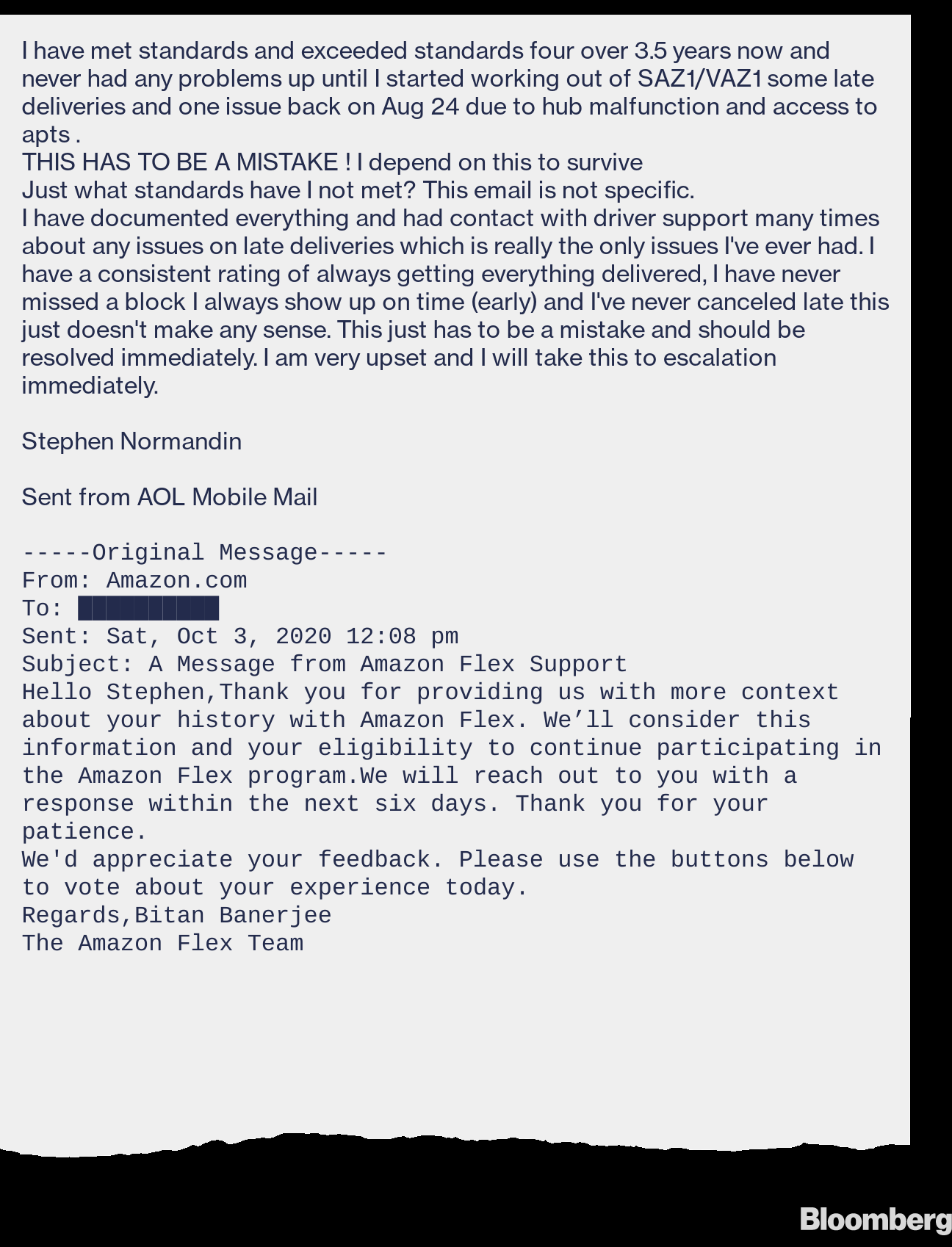

Fired By Bot Amazon Turns To Machine Managers And Workers Are Losing Out Bloomberg

![]()

How Quickly Do I Get Paid Through Amazon Flex Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Stride Mileage Tax Tracker Apps On Google Play

Lg Energy Solution To Set Up Ev Battery Jv With Stellantis In Canada Reuters

How To Apply For Amazon Flex Driver Jobs Career Info

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Frequently Asked Questions Us Amazon Flex

Firms Make Deals To Boost Lng Exports 60 From U S Canada Mexico Reuters

Amazon Tax Canada What You Need To Know A2x For Amazon And Shopify Accounting Automated And Reconciled

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

![]()

Update Amazon Flex Payout Changes Money Pixels

Tax Forms Email R Amazonflexdrivers

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Tax Guide For Canadian Sellers In The United States Canada Baranov Cpa